Industrial Property Tax Services

Optimize your property tax strategy with DMA’s expert services for industrial and centrally assessed properties.

For over fifty years, DMA has been a trusted partner for enterprises across the US and Canada, addressing complex property tax liabilities. We combine industry-leading expertise with exceptional service to deliver impactful results that consistently exceed client expectations.

Minimizing property tax while staying compliant across a portfolio of properties can be complex and resource-intensive.

By leveraging DMA as your expert property tax resource, you can save time and money managing one of your largest operating expenses.

Our property tax expertise includes:

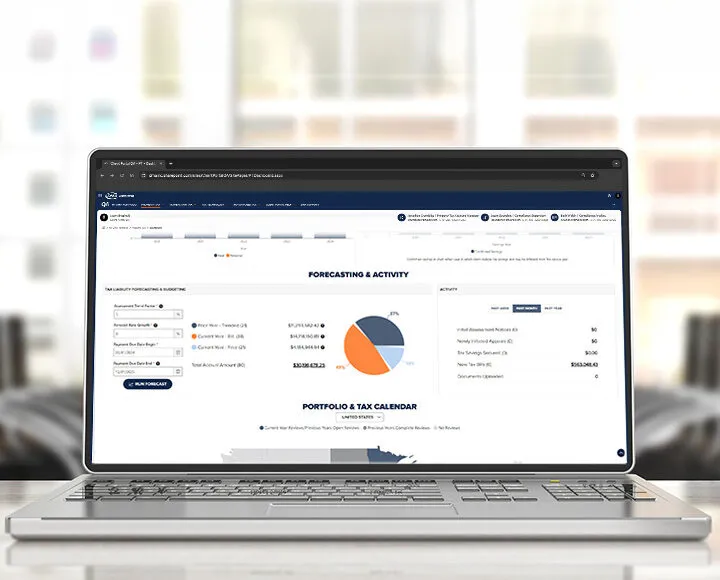

Experience unparalleled transparency and control over your property tax processes with DMA’s industry-leading Property Tax Client Portal. Access real-time updates, detailed reports, and powerful forecasting tools to efficiently manage your property tax portfolio.

From individual reviews and appeals to compliance and full portfolio management, leverage DMA’s expertise as needed. Adjust resources as your needs change—with a partner who puts the client’s interest first.

east

Assessment Review & Appeal

Address potential errors and inconsistencies in your property assessments with our expert review and appeal services, ensuring fair and accurate valuations. east

Compliance

Streamline your property tax obligations with DMA’s comprehensive compliance services, from return preparation to timely filings. east

Audit Management

Navigate property tax audits with confidence using our audit management services, providing expert support from documentation gathering to audit response. east

Fixed Asset Verification

Leverage DMA to verify the existence and condition of personal property assets and correct discrepancies to ensure accurate valuation and compliance. east

Credits & Incentives

Discover opportunities to minimize property tax obligations and maximize investment returns with incentive procurement and site selection services. east

Portfolio Management & Administration

Let DMA manage all aspects of your property tax portfolio, including compliance, assessment review and appeal, filings, payments, audit, and deadline tracking.

For over 50 years, DMA has been at the forefront of property tax consulting, serving the largest public and private companies across the US and Canada. Our rich heritage in property tax expertise allows us to navigate the complexities of valuation and taxation with unmatched proficiency.

Our outcome-based fee structure means we are only paid when we succeed in reducing your property taxes. This performance-driven approach aligns our incentives with your goals, ensuring we are fully committed to achieving the best outcomes for your business.

At DMA, you work directly with senior-level consultants who bring extensive industry knowledge and experience to each engagement. This ensures high-quality service and effective strategies tailored to your specific property tax needs.

DMA’s Property Tax Client Portal offers unparalleled transparency and control over your property tax processes. Access real-time updates, detailed reports, and forecasting tools to manage your property tax portfolio efficiently and effectively.

Our in-house compliance team guarantees superior quality control and a deeper understanding of your business operations. By keeping compliance work internal, we maintain high standards and build stronger client relationships.

With a national network of offices and local expertise, DMA provides comprehensive property tax services across all jurisdictions in the US and Canada. Our blend of local knowledge and national resources ensures optimal results wherever your properties are located.

Being proudly employee-owned means every DMA consultant you work with has a vested interest in your success. This ownership mentality drives our commitment to excellence and client satisfaction.

Our commitment to service is evident in our client-first approach. We prioritize your needs, ensure transparent communication, and deliver results that exceed expectations. At DMA, we aim to build lasting partnerships based on trust and performance.

“We are grateful for the partnership we have shared with DMA for 15 years now. We feel like their folks are a part of our own tax team. They effectively meet our compliance needs and the review and appeal teams have obtained significant tax savings for us over the years.”

Accountant/Property Tax Manager

Kimberly-Clark Corporation

Fill out the form below to connect with our property tax experts. We’ll reach out to discuss your company’s unique property tax needs and explore how DMA can help you achieve significant savings and efficiency.