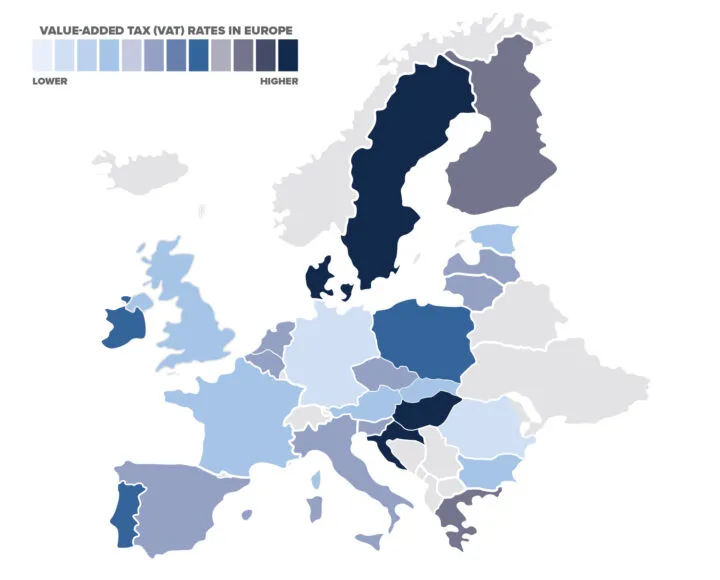

Over 160 countries collect VAT/GST, with rates exceeding 20% in some EU jurisdictions.

Businesses that trade or operate internationally are challenged with managing each country’s value added tax (VAT) compliance regulations and recovery processes—all while keeping their VAT operations compliant and as efficient as possible.

DMA’s global team of VAT professionals and tax technology experts work collaboratively to offer end-to-end VAT services that minimize risk and maximize cash flow.

VAT Recovery

DMA’s global team of VAT experts reviews your entire supply chain to identify potential VAT overpayments or unclaimed taxes. DMA prepares all recovery schedules and supporting documentation, cites appropriate legislation to substantiate our recoveries, and works with the appropriate taxing jurisdiction to secure your VAT refund. Our review concludes with a comprehensive Report of Findings detailing the results of our work, including best practices and recommendations.

VAT Automation

DMA combines VAT technical knowledge, comprehensive tax technology expertise, and experience across industries to provide global tax integration and consulting services. Our team bridges the gaps between the business, IT, and tax teams to ensure the successful global deployment of indirect tax solutions. We automate VAT calculations, design and implement complex global solutions, and develop enhanced reporting and remittance processes for indirect tax.

VAT Advisory

VAT is very complex to navigate—especially when entering new markets, creating new product lines, or providing new service offerings. With industry experience and a pragmatic approach to demystifying VAT, DMA’s experts provide VAT Advisory services to ensure that your company is conducting business in the most efficient manner possible, with the necessary VAT registration, and meeting invoice requirements and compliance obligations in foreign countries where your company has established operations.

VAT Compliance

DMA’s VAT compliance team provides a complete outsourced solution to the complex VAT requirements your company may be facing. Every one of our VAT experts possesses in-depth jurisdictional knowledge to prepare and review all VAT filings—ensuring your company remains compliant throughout the entire process.

The goal of our VAT Compliance service is to develop legally compliant solutions that:

• Minimize risk

• Avoid VAT overpayments

• Reduce administrative burdens on your team

• Ensure local VAT recovery to the fullest extent possible

We apply industry best practices and country-specific expertise alongside the latest in VAT compliance security and software solutions for every engagement. Our flexible approach allows us to collaborate with your team by serving as an extension of your tax department to produce accurate, efficient, and timely results.

Contact Our Team

Ready to learn how DMA’s global team of VAT experts can help your tax operation? Fill the form below and we’ll get in touch, or call us today.