Executive Summary

Month-end tax activities can be a challenge for tax departments, often involving manual data handling, complex accrual processes, and meeting stringent compliance requirements. If left unaddressed, these challenges can lead to inefficiencies, increased workload, and potential compliance risks. By combining strategic planning, advanced tax technology, and expert managed services, DMA provides organizations with a comprehensive approach to overcoming these hurdles.

Drawing from the experience of our client, a Fortune 1000 company in the energy sector, this analysis highlights how DMA’s TaxARC™ software and related managed services address common month-end pain points.

Our client was able to transition from more traditional, labor-intensive methods to a streamlined, automated system that enhanced efficiency, accuracy, and compliance. The insights gained from the transformation can benefit any organization seeking to improve its month-end tax processes.

The Challenges of Month-end Tax Activities

Even with the evolution of tax technology, month-end tax activities remain a significant challenge for many tax departments. Common issues include managing large datasets, handling manual accruals, and ensuring timely compliance across multiple jurisdictions. These processes often require tax professionals to juggle disparate systems and data sources while under tight deadlines, which can slow down operations and increase the risk of missing key details.

To address these challenges, DMA takes a holistic approach by integrating advanced tax technology and managed services. The goal is to reduce manual intervention, improve efficiency, and build a more agile tax function capable of adapting to evolving business and regulatory requirements.

—Catie Budzowski, Senior Manager, Tax Technology

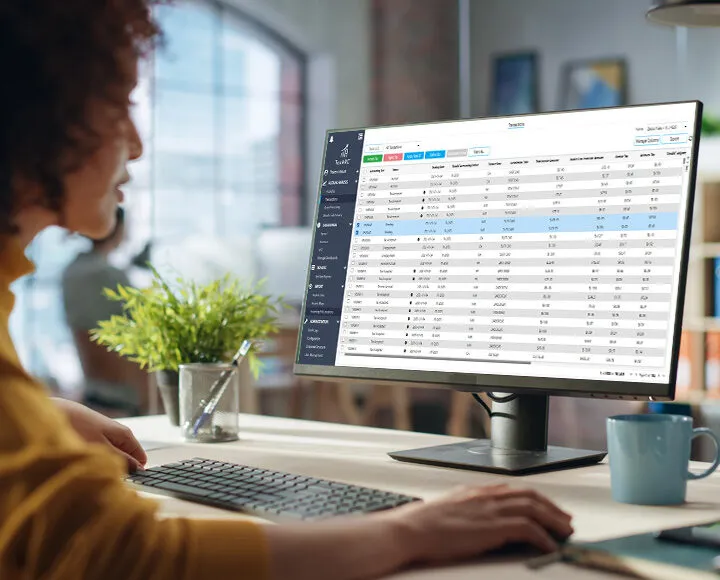

Technology as a Solution: TaxARC™

TaxARC™ is a cloud-based software platform specifically designed to provide analytics into the transaction tax landscape. This solution alleviates the burden tax professionals face during month-end activities and provides tax-relevant data insights. By integrating with existing ERP and source systems, TaxARC™ consolidates tax data into one platform and provides tools to automate and streamline critical tax processes.

TaxARC™ enables tax professionals to evaluate the tax determination of large transactional volumes while maintaining accuracy and improving reporting capabilities. Within DMA’s innovation lab, machine learning models are being generated to provide predictive and suggestive taxability treatment, and OCR functionality to efficiently review and evaluate potential discrepancies between vendor invoices and taxes paid/accruals.

How TaxARC™ Works

Addressing a range of challenges faced by tax professionals, TaxARC™ delivers tailored benefits and adapts to a company’s unique needs and existing technology. It streamlines the month-end review process, enhancing tax accuracy and efficiency, while granting access to data and analytics that support better decision-making.

The Accrual Analysis Module

This module leverages Artificial Intelligence (AI) and automates the review of tax treatment on purchasing data, reducing the manual work typically associated with tax review, adjustments, and additional accruals. It uses advanced logic to auto-process routine transactions and flags exceptions and anomalies that require review.

The Data Warehousing Module

This component stores historical purchasing and sales data, making it easily accessible for audit support and compliance reporting. Its analytics tools allow tax professionals to visualize data trends and generate custom reports.

TaxARC™’s data-agnostic design allows it to accept and process both structured and unstructured data from any ERP or multiple source systems, providing the flexibility to adapt to the unique needs of each organization. Upon finalizing the review, TaxARC™ generates the G/L writeback file for ingestion into the source system, along with an accrual adjustment file for compliance purposes.

This automated process reduces the need for manual intervention and ensures that necessary adjustments integrate seamlessly, enhancing the accuracy of financial reporting. With its flexible and scalable structure, TaxARC™ is an ideal solution for businesses managing complex tax scenarios, regardless of the ERP or transaction volume.

“The automation of TaxARC™ allows for more time to be spent performing manual review on higher value data or, in large part, automating the use tax review process in its entirety. This flexibility and efficiency are game changers for tax departments.”

—Theron Minium, Senior Manager, Tax Technology

Key Benefits of TaxARC™

TaxARC™ streamlines traditionally labor-intensive processes, offering significant advantages:

Enhanced Accuracy

By automating tax calculations and data processing, TaxARC™ reduces the risk of discrepancies and ensures that calculations are reliable.

Improved Efficiency

The software’s intuitive interface, coupled with machine learning and OCR capabilities, helps tax professionals access and analyze data more quickly, reducing the time spent on manual reviews and allowing focus on higher-value tasks.

Scalability and Flexibility

TaxARC™ can be customized to meet the specific needs of organizations, whether they are dealing with complex tax jurisdictions or high transaction volumes.

Audit Readiness

TaxARC™ ensures that all transactions and adjustments are documented and easily retrievable, simplifying audits and compliance reviews.

Tax Managed Services: Extending The Capabilities Of Tax Departments

In addition to innovative technology like TaxARC™, DMA offers tax managed services that act as a strategic extension of tax departments. These services help organizations navigate tax complexities, ensuring smooth operations while freeing internal teams to focus on higher-value initiatives.

Our flexible solutions provide expert support across critical areas, enabling businesses to maintain compliance, reduce inefficiencies, and adapt to evolving needs without increasing headcount.

Core Tax Managed Services

Tax Engine Maintenance and Support

DMA manages complex configuration tasks, such as mapping products and services, updating tax content, troubleshooting tax calculations, and ensuring nexus settings are accurate. This service ensures tax engines operate efficiently, helping businesses stay compliant and avoid calculation errors.

Tax Systems and Integration Management

DMA supports system infrastructure by managing network connectivity, preventative maintenance, and server health. These services ensure smooth tax system operations, including SAP maintenance and tax performance troubleshooting, minimizing downtime and operational disruptions.

Data Automation and Reporting

DMA automates key processes, including monthly accruals, account reconciliation, and pre-filing data preparation. This automation reduces manual intervention, ensures greater accuracy, and allows for seamless generation of custom tax reports tailored to business needs.

Use Tax Accrual Analysis

Utilizing technology and industry expertise, the DMA team reviews and validates use tax accruals to ensure accuracy, identify potential discrepancies, and minimize risk.

Exemption Certificate Management

Collecting, validating, troubleshooting, and reporting on exemption certificates can be labor-intensive. DMA’s service simplifies these tasks, ensuring certificates are properly managed, reducing audit risks, and improving compliance efficiency.

Tax Advisory Services

DMA’s tax advisory support includes monitoring business activity, researching nexus and taxability, and offering strategic guidance. These services empower businesses to navigate changing regulations, optimize tax strategies, and stay ahead of compliance requirements.

Compliance Support

From filing returns and tracking tax credits to managing tax notices and preparing amended returns, DMA’s compliance services ensure businesses meet their obligations accurately and on time. DMA acts as a trusted partner, handling operational details so internal teams can focus on strategic objectives.

“DMA’s managed services are designed to scale with a company’s growth, resource needs, or operational changes. Our goal is to alleviate the burden of routine tasks and allowing tax departments to focus on what really matters—delivering strategic value to their organizations.”

—Joshua Erickson, Director, Tax Technology Team Lead

A Case Study in Transformation

As one of the largest integrated energy companies in the US, our client operates across numerous states and business entities, making month-end tax activities complex. Prior to implementing TaxARC™, the company relied on manual processes to manage these activities, which took significant time and required careful attention to maintain compliance.

Challenges Faced by Our Client

The company’s tax department experienced challenges typical of large organizations:

Manual General Ledger (GL) Adjustments

The team spent considerable time preparing and reconciling general ledger entries and manually reviewing data from various systems. These manual efforts, while effective, limited the time available for strategic tasks.

Limited Visibility into Vendor-Charged Taxes

The company sought greater transparency into vendor-charged taxes, enabling it to verify compliance and avoid potential overpayments.

Audit Readiness

Ensuring comprehensive documentation of tax decisions and adjustments across multiple entities was time-consuming and could complicate audit preparations.

Implementing the TaxARC™: Solution and Outcomes

DMA worked closely with our client’s team to implement TaxARC™, transforming its month-end tax activities. The key outcomes of this collaboration included:

Automated GL Adjustments

TaxARC™ enabled the automation of general ledger adjustments, saving our client’s tax team significant time by allowing direct uploads to its ERP system and reducing manual data entry.

Increased Vendor-Charged Tax Visibility

Our client gained greater insight into vendor-charged taxes through TaxARC™, which identified discrepancies proactively and optimized its tax engine settings.

Improved Audit Readiness

With TaxARC™’s robust data warehousing, our client’s tax department can store and access historical data easily, ensuring they are well-prepared for audits.

Successful Outcomes

Time Savings and Efficiency Gains

Automation allowed the company’s team to reduce time spent on manual tasks, accelerating month-end close processes and freeing up resources for more value-added activities.

Enhanced Compliance

Greater visibility into tax data and enhanced accuracy in determinations helped our client minimize risks and ensure more reliable tax compliance.

Strategic Decision-Making

Real-time access to comprehensive tax data enabled better decision-making and the identification of potential cost savings.

“TaxARC™ has been a fantastic tool for us. It’s helped us capture unique scenarios that the tax engine can’t handle on its own. We think we’re maybe 90 or 95% accurate, but that 5 or 10% really matters.” —Client’s Tax IT Team Lead

Conclusion and Key Takeaways

Streamlining month-end tax activities is more than just reducing workload—it’s about enhancing compliance, improving accuracy, and enabling tax departments to operate more strategically. DMA’s comprehensive solutions, as demonstrated through our client’s transformation, provide a clear path toward achieving these goals.

By adopting advanced technology like TaxARC™ and leveraging DMA’s managed services, tax departments can move beyond manual processes to unlock new efficiencies, reduce risks, and enhance compliance.

These tools and services empower teams to focus on higher-value activities, respond proactively to business and regulatory changes, and drive long-term value for their organizations.

“We’re always looking for ways to improve efficiency and mitigate risks. Partnering with DMA allowed us to not just automate processes but to completely rethink how we handle tax compliance.” —Client Team Lead

Ready to transform your month-end tax processes?

Discover how DMA’s TaxARC™ indirect tax analytics solution can streamline your workflows and improve productivity.