Fill out the form to see how the capabilities of our portal can help manage your corporate tax activities—all in one place.

Access Your Data in

Real-Time

Our Client Portal provides a complete real-time overview of all engagements with DMA and your corporate tax activities, consolidating essential tools and information in one place.

Reviews Dashboard

Quickly see all active and complete reviews

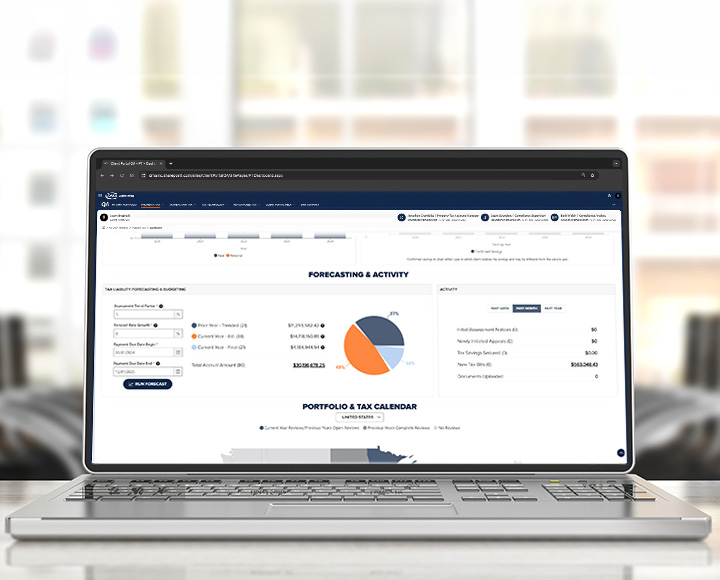

Forecasting and Budgeting

Estimate your tax liability and plan

Projects Dashboard

See all projects across all services

Assessments and Appeals

View all assessments, appeals, taxes, and confirmed tax savings

Tax Technology

Access project burn rate dashboards and easily transfer files

Compliance

Track all property and transaction tax returns

Portfolio and Property Views

Navigate properties by map or search your portfolio

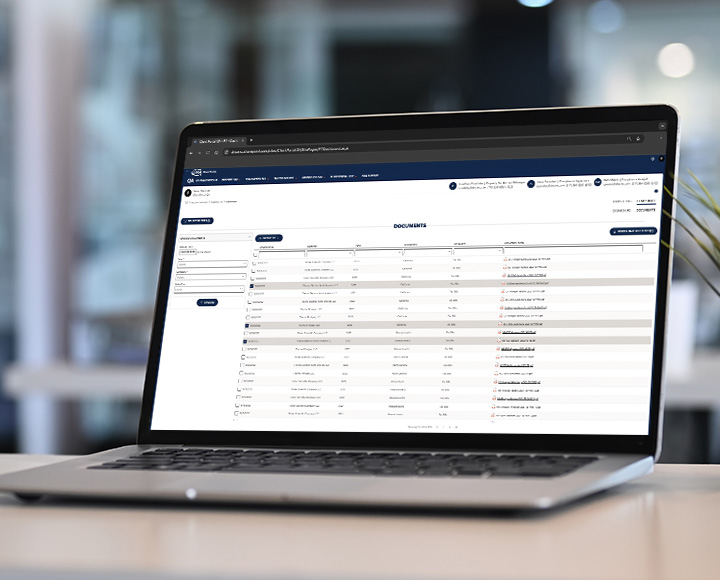

Document Management

Efficiently manage and share critical documents

Property Tax Management Tools

DMA’s Property Tax Client Portal provides a complete real-time overview of all your property tax activities, consolidating essential tools and information all in one place.

Access up-to-date information on property tax activities, gain comprehensive visibility into your entire portfolio, and utilize advanced forecasting tools to plan accurately and reduce tax liability.

- Property Tax Dashboard: Access valuations and assessments for property, total liabilities, appeal outcomes, and current-year assessment review statuses.

- Forecasting and Budgeting: Estimate your property tax liability with advanced tools tailored for acute forecasting, customized budgeting, and financial planning.

- Portfolio and Property Views: Navigate properties and manage comprehensive data for each property, organize documentation, and track compliance.

- Document Management: Securely store all critical property tax files and seamlessly share them with your team and DMA consultants.

Transaction Tax Management Tools

Transform your approach to transaction tax compliance, audits, and reviews with data-driven insights and streamlined processes. DMA’s Transaction Tax Client Portal provides a complete overview of your transaction tax activities, consolidating all information in one easy-to-use dashboard.

- Comprehensive Filing: Access a complete archive of your tax filings, stay ahead of deadlines with an interactive calendar that highlights upcoming filing dates and provides automatic reminders, and effortlessly manage multi-jurisdictional tax obligations.

- Advanced Tax Notice Management: Streamline tax notice processes with our automated system featuring OCR technology for quick sorting and identification, reducing human error and ensuring timely responses.

- Credit Tracking and Management: Monitor and manage tax credits with precision, ensuring you capitalize on every opportunity to optimize your tax position.

- Customizable Reporting: Generate tailored on-demand reports instantly, drill down into the details behind each filing, and leverage advanced analytics and self-service dashboards for unprecedented insights into your data.

- Comprehensive Review Tracking: Monitor review statuses across all 50 states, leverage our color-coded map for quick geographical insights, and use customizable filters to view the information that matters most to your business.

- Advanced Audit Management: View audit progress in an interactive timeline, identify potential audit triggers, and generate detailed audit reports.

Tax Technology Management Tools

Effortlessly track and manage your tax technology initiatives with DMA’s advanced tools designed to simplify complex projects and enhance collaboration:

- Burn Rate Dashboard: Monitor your project’s progress with precision. View burn rates by waves and phases, track the percentage of the budget used, and maintain a clear overview of project performance.

- File Sharing Hub: Streamline collaboration between your internal tax team and your DMA team of experts with a secure, centralized space for file sharing. Easily upload, download, and organize critical documents to keep your tax technology projects on track.

- Comprehensive Project Insights: Gain real-time insights into your tax technology projects, ensuring effective resource management and seamless coordination with your DMA team.