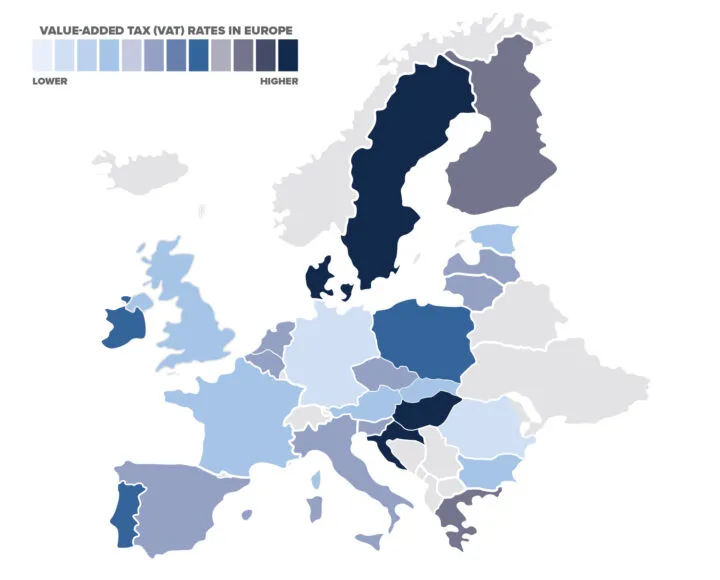

VALUE ADDED TAX (VAT) SERVICES

DMA’s international team of VAT/GST experts works alongside your tax team to ensure your company is compliant with all tax jurisdictions in which you do business, offering services in:

- Recovery

- Automation

- Advisory

- Compliance

Learn more about our VAT practice:

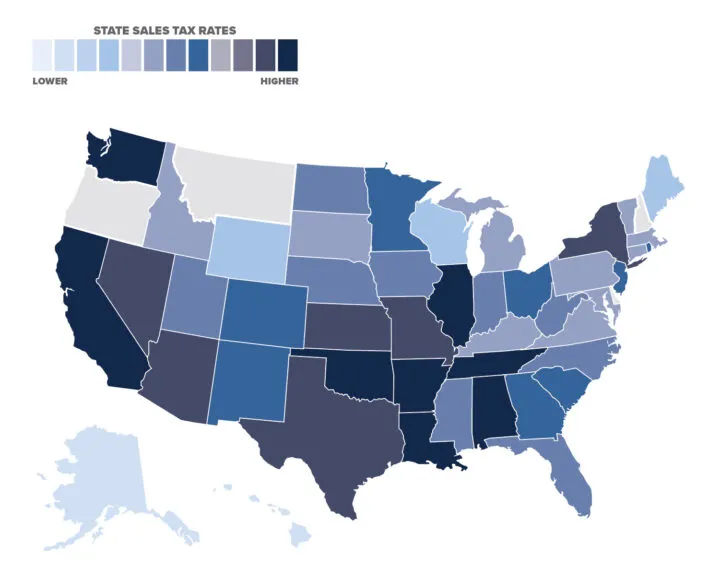

SALES/USE TAX (US AND CANADA)

As a US-headquartered organization, DMA supports European companies that operate in North America with authoritative knowledge of its multitude of tax jurisdictions. Our sales/use tax (US) and GST/HST/QST/PST (Canada) services include:

- Compliance

- Tax Recovery

- Audit Management & Defense

- Advisory

- Tax Process Optimization

Learn more about our US and Canada transaction tax practices:

TAX TECHNOLOGY

Our tax technology professionals employ extensive experience with tax engines and ERP systems to help you simplify, and maximize the benefits of tax automation through:

- Tax engine selection, implementation, and management

- Tax technology consulting

- Tax workflow optimization

- Transaction tax software and integrations

Learn more about our tax technology services:

east